Texas Tax Exemption Form

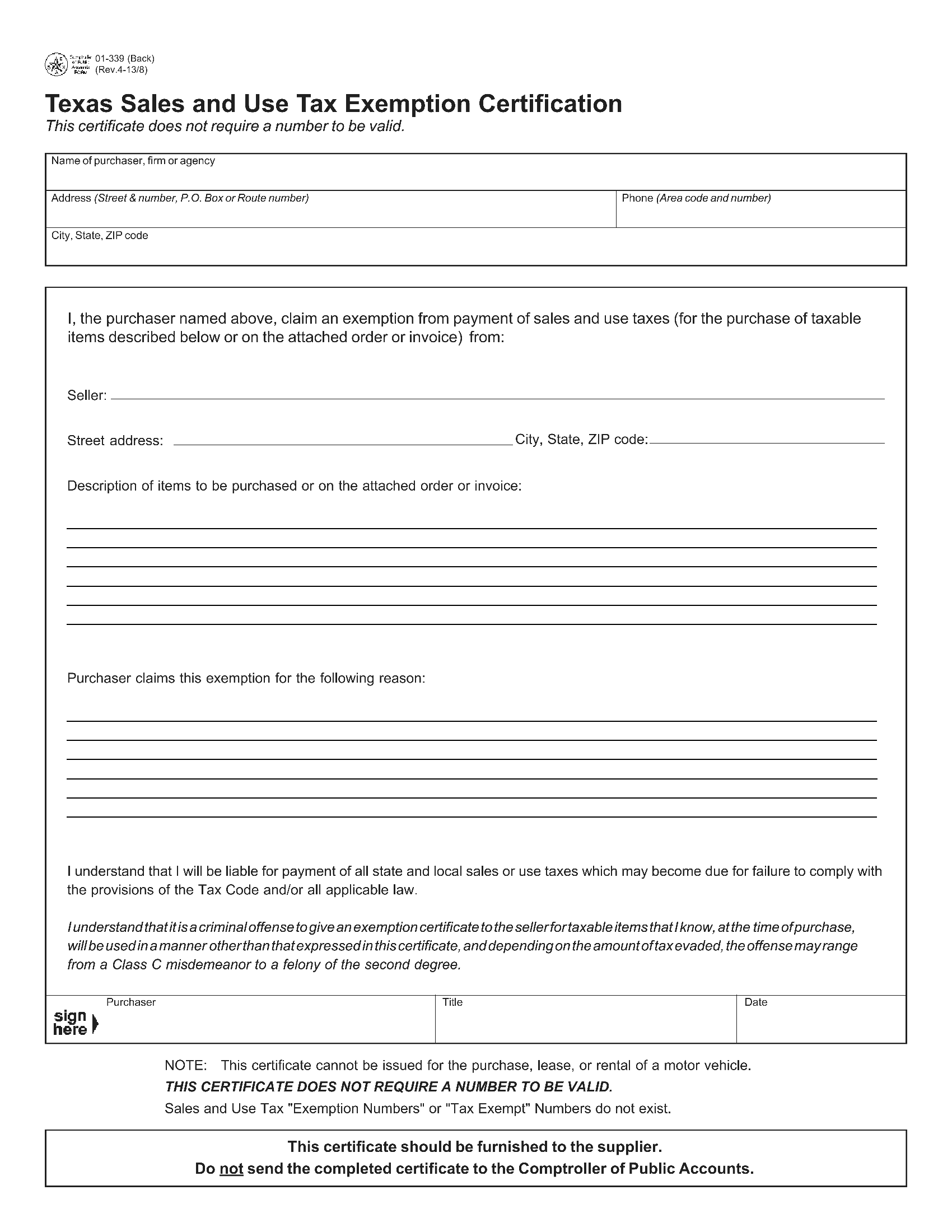

Texas Tax Exemption Form - Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the texas sales tax. This certificate does not require a number to be valid. Web download and print a certificate to claim an exemption from sales and use taxes for the purchase of taxable items in texas. Find the appropriate application form and more. For applications for tax exemption, see the agricultural. Fill in the required information and sign the certificate before presenting.

Exemption applications can be submitted by mail, online, or at our office: Web in order to verify your exemption benefits, you must submit a new exemption application. Purchaser claims this exemption for the following. Web texas sales and use tax exemption certification. The form is updated on 04/12/2021 and.

This form should only be used for official university. For applications for tax exemption, see the agricultural. Fill in the required information and sign the certificate before presenting. Web learn how to apply for sales, franchise or hotel tax exemptions based on your organization's federal or state status. Purchaser claims this exemption for the following.

This certificate does not require a number to be valid. This certificate does not require a number to be valid. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web the texas sales and use tax exemption certification form is available from the texas comptroller of public accounts..

Exemption applications can be submitted by mail, online, or at our office: Learn the requirements, rules, and penalties for. Find the appropriate application form and more. All purchases of the texas a&m university system members: Web texas sales and use tax exemption certification.

Purchaser claims this exemption for the following. Web learn how to apply for sales, franchise or hotel tax exemptions based on your organization's federal or state status. Fill in the required information and sign the certificate before presenting. Web the texas sales and use tax exemption certification form is available from the texas comptroller of public accounts. Web texas sales.

Web the texas sales and use tax exemption certification form is available from the texas comptroller of public accounts. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the texas sales tax. The form is updated on 04/12/2021 and. This certificate does not require a.

Texas Tax Exemption Form - Download and print the forms you need or file electronically online. Irs form 1023 (pdf) application for recognition of exemption and instructions (pdf). All purchases of the texas a&m university system members: For applications for tax exemption, see the agricultural. The certificate does not require a number and does. Web download and use this form to claim an exemption from sales and use taxes for taxable items purchased by utsa.

For applications for tax exemption, see the agricultural. Web download and print the official form for claiming a resale or exemption from sales and use taxes in texas. Web find pdf forms for various types of tax exemptions in texas, such as federal, charitable, educational, religious, and performing charitable functions. Learn the requirements, rules, and penalties for. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the texas sales tax.

Web Texas Sales And Use Tax Exemption Certification.

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the texas sales tax. Web texas sales and use tax exemption certificate. Web download and use this form to claim an exemption from sales and use taxes for taxable items purchased by utsa. Web download a copy of the texas sales and use tax exemption certificate from the tax form section of the state of texas website (see resource).

Web The Texas Sales And Use Tax Exemption Certification Form Is Available From The Texas Comptroller Of Public Accounts.

Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. This certificate does not require a number to be valid. Web download and print the official form for claiming a resale or exemption from sales and use taxes in texas. Web download and print a certificate to claim an exemption from sales and use taxes for the purchase of taxable items in texas.

Web In Order To Verify Your Exemption Benefits, You Must Submit A New Exemption Application.

The certificate does not require a number and does. Web find pdf forms for various types of tax exemptions in texas, such as federal, charitable, educational, religious, and performing charitable functions. Web find pdf forms for various sales and use tax applications, returns, exemptions, and certificates. Web learn how to apply for sales, franchise or hotel tax exemptions based on your organization's federal or state status.

Understand That I Will Be Liable For Payment Of All State And Local.

Learn the requirements, rules, and penalties for. Web find preprinted forms for various texas taxes, including sales and use tax, franchise tax, motor vehicle tax, and more. Understand that i will be liable for payment of all state and local. Download and print the forms you need or file electronically online.